Foreigners can buy a property in Australia. This right is granted to those who are residents of Australia but it must be noted that persons who do not live here and simply want to own property can also purchase it.

However, the procedure is bound by certain limitations, including the approval of the Australian government. If you are not a resident and you are interested in purchasing real estate, our Australian law firm remains at your service for legal assistance on any property matter.

What are the conditions for buying property as a foreigner?

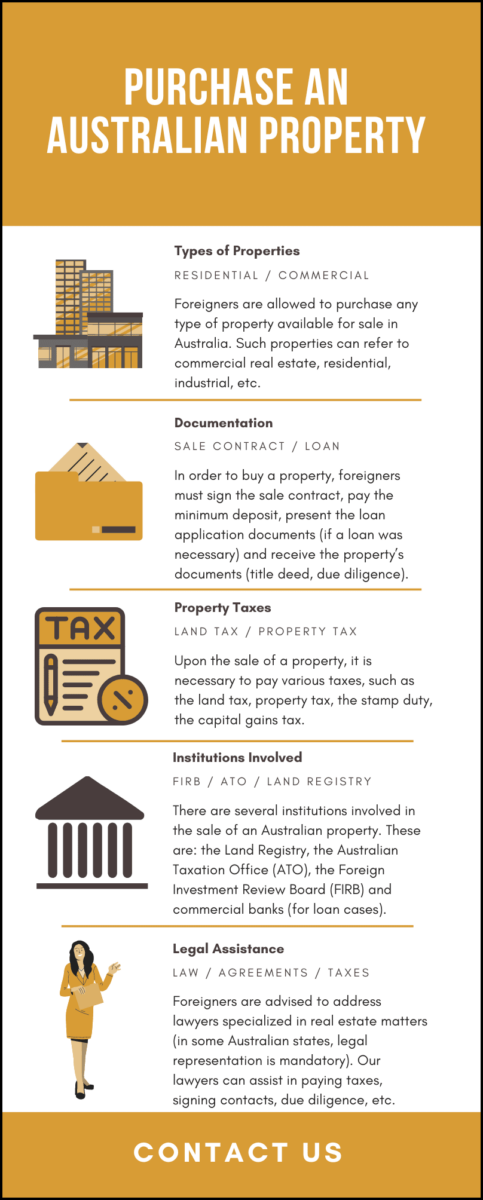

It is possible to purchase a property in Australia as foreigner. It must be noted that the property itself must meet certain requirements and that the applicant must comply with certain regulations, in the sense that a set of approvals are necessary.

| Quick Facts | |

|---|---|

| Types of properties foreigners can purchase | Residential property, commercial property, industrial property, specialized properties, etc. |

|

Mandatory legal representation (yes/no) |

No, but it is highly recommended (in some states, the sale contract can be prepared by a property lawyer). |

|

Main legal responsibilities of property lawyers |

If you want to buy a property in Australia, the services of property lawyers can be necessary when: – preparing sale agreements (in some Australian states, only persons specialized in property law can prepare these documents); – offering legal advice on the property law; – making sure all the legal procedures are completed as required by the law; – observing if the property is sold by respecting the criteria in the sale agreement; – providing assistance on the taxes to be paid, etc. |

| Due diligence (yes/no) | Yes |

| Documents necessary for the property purchase |

– the sale contract; – make an offer of interest; – loan application documents (if necessary); – documentation attesting that a building inspection has been completed; – establish the type of ownership; – payment of the deposit (usually, 10%). |

| Main property taxes |

– the stamp duty (unless exempted for certain categories of buyers and properties); – the capital gains tax; – land tax; – property tax. |

| Parties involved in the sale/purchase of a property |

– the buyer; – the seller; – the conveyancer/property solicitor; – commercial banks (when a mortgage is necessary); – the Australian Taxation Office (for tax payments); – the Land Registry Services (for property transfer matters); – the notary public. |

| Fees charged by notaries/lawyers (if applicable) |

Notarial fees vary from one state to another and from one service to another. For instance, the certification of property transfers can cost from $180. Lawyers’ fees can range from $2,000 to more than $3,000 depending on the property type, its value and the transaction type (loan/no loan). |

| Law regulating property and property sales in Australia |

Foreigners can buy a property in Australia following the rules of the Civil Law (Sale of Residential Property) Act 2003 and other regulations available in each state. |

| Conditions to purchase for EU nationals |

EU nationals can purchase property following the rules applicable to all foreigners who are not residents in Australia. The process for foreigners starts by obtaining an approval from the Foreign Investment Review Board (FIRB). |

| Conditions to purchase for non-EU nationals |

Non-EU nationals must follow the same conditions imposed to EU nationals and other third party foreigners. |

| Documents necessary for the purchase of commercial/industrial property |

If you want to buy a property in Australia for commercial purposes, the following are necessary: – the sale contract; – GST documents (as the property is for commercial purposes); – financial approval (where necessary); – company documents of the seller and the buyer; – FIRB approval, when the buyer is a foreign entity; – disclosure documents; the certificate of title; – safety regulations compliance, as per the rules of the Building Regulations 2006. |

| Institutions involved in the registration of new ownership |

The Land Registry Services |

| The mandatory provisions of a property sale contract |

The parties, the conditions of the sale, the object of the contract, deadline to meet the obligations of each party, the selling price, the rights of the parties. |

| Types of property contracts to sign in Australia |

Contract of sale for residential property, contract of sale for commercial properties. It must be noted that each Australian state has different requirements for a legally recognized property sale contract. |

In the list below, our lawyers in Australia have gathered the basic information that is necessary to know as foreigner (who is not living in Australia) interested in buying real estate:

- foreign applicants are required to submit an application in which they mention they want to buy a property in Australia, application that is submitted to the Foreign Investment Review Board;

- then, the applicant must wait for the review of the application and if successful, the foreigner can purchase the property;

- however, the property itself must meet certain standards – it must be either a new property or a vacant land suitable for residential property, where the new property owner can build a new dwelling.

The legislation stipulates that if a foreigner will buy a property in Australia that is an established dwelling, then he or she is required to live in the respective property. As such, this means that the foreigner will relocate here for long-term residency.

Additionally, if the person decides to relocate elsewhere, thus not being able to live in the respective property, it is necessary to sell the dwelling. Our Australian lawyers can offer more details on other obligations deriving from this rule. We invite you to watch a short video presenting how to purchase an Australian property:

Are there any fees charged to those who buy property in Australia?

Yes, just like in the case of most states around the world, the sale-purchase procedure of a property implies the payment of certain fees and taxes. When initiating this procedure as a foreigner, you will be required to pay certain fees, charged by the Foreign Investment Review Board (FIRB).

These fees are updated on a yearly basis (as it is the case of any other fees charged by Australian institutions). Please mind that in Australia, the financial year starts from 1st of July and ends on 30 June, therefore the fees are established for this period of time.

For the period of 1st of July 2023 to 30th of June 2024, the fees charged by the institutions are the ones mentioned below (please mind that the fees vary based on the price charged when you buy a property in Australia):

- if you purchase a property in Australia that costs less than $75,000, the fee is $4,200;

- for properties with a value above this sum and of maximum $1 million, the fee is $14,100;

- for properties valued at a price above $1 million and maximum $2 million, the fee is $28,200;

- other thresholds are $56,400 (properties below $3 million), $84,600 (properties below $4 million) and $112,800 (properties below $5 million);

- it must be noted that foreigners who purchase a property in Australia are required to pay a Foreign Citizen Stamp Duty, which varies based on the region and which is applied at a rate of 7% or 8%.

For example, the Foreign Citizen Stamp Duty in New South Wales is 8%, while in Queensland is 7%. Please mind that it is mandatory to obtain an approval from the above-mentioned institution. Temporary residents must follow the same procedure mentioned in the article if they want to buy a property in Australia. For additional information, our Australian law firm remains at your service.